Next-Gen Payments: How Crypto and FinTech Are Changing Online Checkout

Online checkout is no longer just about credit cards and bank transfers. As consumer expectations evolve, next-gen payments driven by crypto and FinTech innovations are reshaping how people pay online—making transactions faster, smarter, and more inclusive.

From blockchain-based currencies to mobile wallets and embedded finance, this shift is redefining the checkout experience for both businesses and consumers.

The Rise of FinTech in Online Checkout

From Traditional to Frictionless

FinTech has transformed online checkout by removing friction from the payment process. Modern solutions focus on:

- Speed and convenience

- Mobile-first design

- Seamless integration across platforms

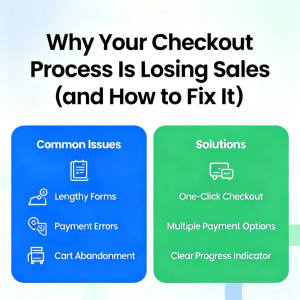

Technologies such as digital wallets, one-click payments, and buy-now-pay-later (BNPL) have significantly reduced cart abandonment rates and improved conversion.

🔗 Outbound link: McKinsey – The Future of Payments

https://www.mckinsey.com/industries/financial-services/our-insights/payments

Crypto Payments: A New Checkout Paradigm

Borderless and Decentralized

Cryptocurrency introduces a fundamentally different payment model. Instead of relying on intermediaries, crypto enables:

- Peer-to-peer transactions

- Global payments without currency conversion

- Lower transaction fees

For international e-commerce, crypto reduces barriers related to banking access, cross-border fees, and settlement delays.

🔗 Outbound link: Investopedia – Cryptocurrency Payments

https://www.investopedia.com/cryptocurrency-4427699

Speed and Security at the Core

Why Users Are Adopting Next-Gen Payments

Modern consumers expect payments to be:

- Instant

- Secure

- Transparent

FinTech platforms use tokenization, biometric authentication, and AI-driven fraud detection to enhance security. Meanwhile, blockchain technology offers immutable transaction records, increasing trust and reducing chargebacks.

🔗 Outbound link: World Economic Forum – Digital Payments Security

https://www.weforum.org/topics/digital-payments/

Embedded Finance and Invisible Checkout

Payments That Blend into the Experience

One of the biggest FinTech trends is embedded finance, where payments are seamlessly integrated into apps and platforms. Users can pay without being redirected or even noticing the transaction process.

Examples include:

- In-app wallets

- Subscription-based billing

- Background crypto settlements

The result is an “invisible checkout” that prioritizes user experience.

Benefits for Businesses

More Options, More Conversions

By adopting next-gen payments, businesses gain:

- Access to global customers

- Lower processing costs

- Faster settlement times

- Improved customer satisfaction

Offering crypto and FinTech payment options also positions brands as innovative and future-ready, especially among younger, tech-savvy audiences.

🔗 Outbound link: Forbes – FinTech Trends in Payments

https://www.forbes.com/fintech/

Challenges and Considerations

Adoption Still Requires Strategy

Despite the benefits, next-gen payments come with challenges:

- Regulatory uncertainty around crypto

- Price volatility of digital assets

- Integration and education costs

Successful adoption requires clear policies, trusted providers, and user education to ensure confidence and compliance.

The Future of Online Checkout

As crypto matures and FinTech continues to innovate, online checkout will become:

- More personalized

- More global

- Less visible

Payments will shift from a final step to a strategic part of the customer journey, influencing loyalty and brand perception.

Conclusion

Understanding next-gen payments and how crypto and FinTech are changing online checkout reveals a major transformation in digital commerce. Faster transactions, enhanced security, and frictionless experiences are redefining how value moves online.

For businesses and consumers alike, the future of checkout is not just digital—it’s intelligent, decentralized, and user-centric.

Post Comment